Your priority is protecting indemnity spend and getting results. Ours is giving you the tools, tactics and legal expertise to do it.

Fraud threats evolve quickly - from AI-driven image manipulation to shifting cost regimes. You need an agile response. That’s why we’ve developed targeted strategies to detect and disrupt UK motor fraud across both third party and first party claims.

In the last 12 months, we've supported clients with:

- The use of generative AI to manipulate vehicle damage imagery..

- Risks linked to the extension of fixed recoverable costs, including claims layering

- Implausible injuries arising under the Civil Liability Act.

We also advise global clients on emerging fraud risks, including:

- Hosting a fraud strategy roundtable for a major Nordic insurer.

- Developing tailored defence strategies with a US client to counter deepfake and shallowfake threats.

Early fraud detection

Detecting fraud early is critical to controlling cost and improving outcomes. Our fraud detector technology helps you do exactly that - identifying suspicious claims early, categorising fraud types, and routing cases to specialist handlers for optimal results.

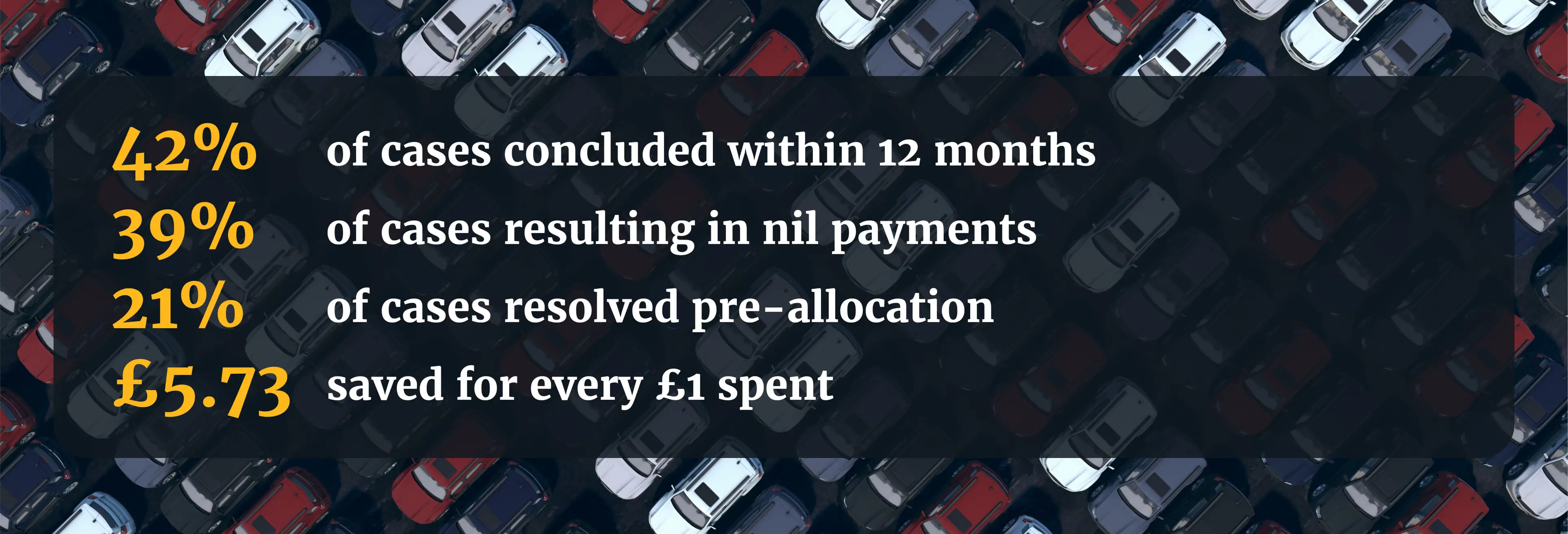

Clients using Fraud Detector have achieved:

You’ll also receive targeted intelligence through our ‘know your opponent’ alerts, highlighting emerging fraud trends.

Our monthly insight meetings bring clients together to share intelligence and shape early, coordinated fraud strategies.

In addition, Kennedys has access to a significant proportion of the market’s MOJ and OIC Portal data - giving you a unique advantage through early, actionable insights.

Organised fraud

Our special tactical operations solution (STOPs) targets organised fraud and enabler profiles with early, time-bound investigations that reduce claim lifecycles, litigation rates and indemnity spend.

We work across all UK jurisdictions - collaborating with counter-fraud lawyers in Scotland and Northern Ireland - to identify and disrupt patterns of organised behaviour. Our approach delivers market-wide disruption and quick, measurable savings.

Our lawyers are recognised for leading strategic litigation and working closely with bodies such as IFED and police forces nationwide.

Our team members have led high-profile organised fraud cases, including:

Credit hire fraud

Our fraud team is experienced in distinguishing sharp practice from genuine fraud in credit hire cases. We’ve developed targeted ‘know your opponent’ strategies for specific credit hire organisations, informed by data and proven patterns of behaviour.

We use a robust triage process to ensure fraud lawyers are only deployed when the evidential picture supports it - controlling cost while focusing resource where it adds the most value.

Claims are accepted into our fraud team where there are strong prospects of a dishonesty finding. This includes cases where the claimant has materially misrepresented:

- Accident circumstances

- Heads of loss

- Documentation (e.g. fabricated invoices, hire agreements)

We also deliver tailored strategies where credit hire fraud overlaps with bent metal enablers, such as engineers whose fabricated opinions are used to justify inflated or fraudulent claims. In these cases, we help you identify and act on toxic patterns.

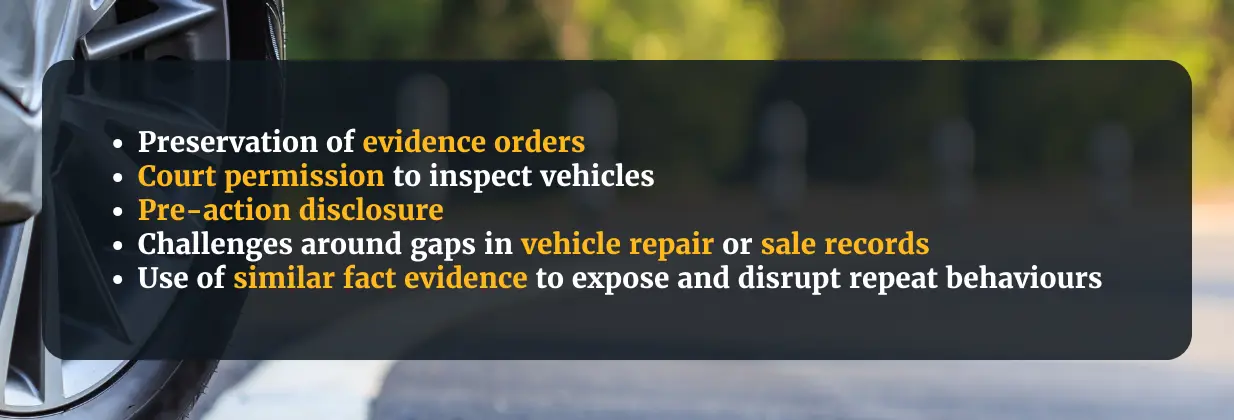

Where this type of fraud is suspected, we can work with you to deploy wider disruption tactics, including:

Low speed impact claims

Our LSI strategy builds a clear evidential picture and ties claimants to a fixed version of events. This enables effective credibility challenges and supports findings of dishonesty where appropriate.

We take a pragmatic, cost-effective approach - focusing on early, robust repudiation, and leading with witness evidence and factual inconsistencies.

Through our triage process, we identify:

- Cases rooted in dishonesty

- Claims from genuinely vulnerable individuals

- Cases with poor prospects, which are resolved economically